I am excited to announce our upcoming webinar on Non-Maturity Deposit (NMD) Modeling. Join me to discover the merits of my innovative approach to modeling NMDs in which the the treatment of behavioral cashflows is synchronized across risk and profitability…

Read MoreAfter two very long years of Covid-motivated webcasts, DGA is excited to announce the return of our live, in-person workshops. We have desperately missed these events and cannot wait to be back in front of a live audience. We are…

Read MoreAnnouncing The Following FTP Workshops For Q4 2018: San Francisco, 18-19 July 2019 Mexico City, 10-11 September 2019 Atlanta, 18-19 November 2019 With interest rates quickly changing direction, many banks are finding that their processes for computing and forecasting product-…

Read MorePreparing for a Change in the Direction of Interest Rate Movements I want to thank the delegates from banks in India, Puerto Rico and the US who attended my workshop in Miami this week. (As promised, mojitos were served and…

Read MoreSeasoned Perspectives on the Past and Future of ALM I am honored to have participated in Risk’s ALM Conference in Toronto at the end of May. Along with several experienced ALM managers, FTP managers and consultants (June Wang, Karl Rubach,…

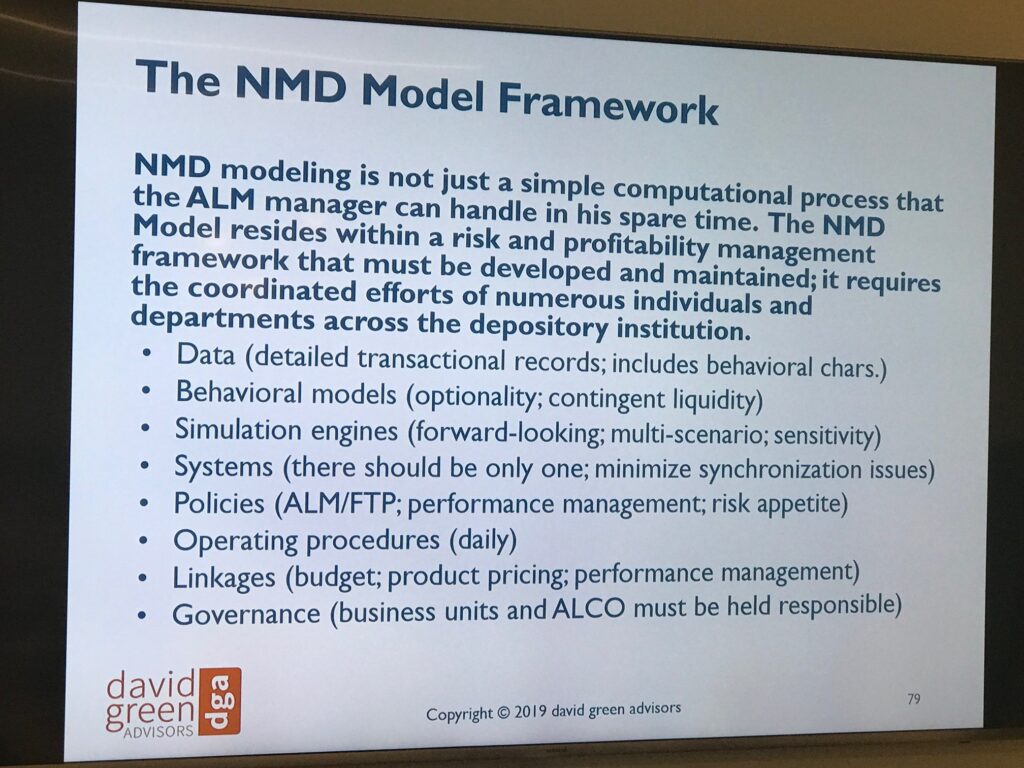

Read MoreA Methodical Approach to Developing and Managing a Model of Non-Maturity Deposits Thanks to everyone for attending my latest NMD Modeling workshop which was held in Chicago at the end of May. Several banks from across the US and South/Central…

Read MoreAre you ready for the next move in rates and liquidity spreads? Thanks to Marcus Evans and the delegates to my recent ALM Workshop in New York for another exciting discussion about the role of FTP in quantifying and managing…

Read MoreWow, I had an amazing time at my ALM workshop in Santo Domingo (and in Punta Cana afterward!). I want to thank all the delegates (representing all the major banks from the DR) who participated. It was an honor to…

Read MoreAnnouncing ALM Workshops For Q1 & Q2 2019 Santo Domingo, Dominican Republic, February 21st-22nd, 2019 New York, New York, February 27th-28th, 2019 Miami, Florida, June 18th-19th, 2019 As interest rates moved higher last year, many depository institutions found that they…

Read MoreThanks to the large group of delegates from Colombia and Chile who attended my FTP workshop in Santiago. Once more, I observed that bankers in Central and South America are much more aware of the necessity for FTP for effective…

Read More