Quote

More often forecasts are made and then…nothing. Accuracy is seldom determined after the fact and is almost never done with sufficient regularity and rigor that conclusions can be drawn. The reason? Mostly it’s a demand-side problem: The consumers of forecasting – governments, business, and the public – don’t demand evidence of accuracy. So there is no measurement. Which means no revision. And without revision, there can be no improvement.

− Superforecasting: The Art And Science Of Prediction, Philip Tetlock And Dan Gardner

Interpretation

If boards and executive management teams at depository institutions are unsatisfied with finance’s and the business units’ ability to forecast earnings with sufficient accuracy and granularity, they must demand more rigor, but of course more rigor requires more accurate methods of quantifying earnings. Because interest rate and liquidity risk are intrinsic to the business of banking, forecasting and reconciliation processes must acknowledge the level and volatility of earnings that are associated with these risks. This requires funds transfer pricing (FTP), but not FTP the way it is practiced at most institutions; profitability cannot simply be assumed. Quantitatively sound measures of transaction-level margins (FTP spreads) must demonstrate economic integrity, else the resulting profit measures will be a source of noise in all resulting risk and balance sheet management processes. There may be revisions, but there will almost certainly be no improvement.

− David Green

Quote

It is difficult to get a man to understand something when his salary depends upon his not understanding it.

− Upton Sinclair

Interpretation

A lot of people in a bank benefit from significant flaws in risk and profitability management processes. These people may feign ignorance, claim that FTP is unnecessary, try to sell management on the myth of a balanced balance sheet or even go so far as to claim that equity has an innate duration, all in an attempt to justify earnings that do not rightly belong to them.

− David Green

Quote

Not only are they [conflicts of interest] ubiquitous, but we don’t seem to fully appreciate their degree of influence on ourselves and on others.

Interpretation

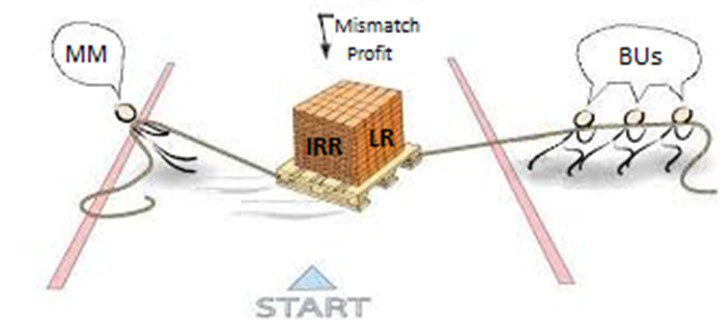

Asset/Liability Committees are inherently plagued with conflicts of interest. Many of the members sitting around the table represent the interests of their business units, i.e. their personal pocketbooks, while they are challenged to vote and opine upon policies and methodologies for funds transfer pricing which are necessary for fair treatment of the mismatch center. When it’s not clear who owns the mismatch, i.e. who should be held accountable for the earnings associated with interest rate and liquidity risk, it’s easy to see how FTP rules are prone to be skewed in favor of the business units.

− David Green

Quote

If your heads of marketing and retail banking cannot define deposit duration, you don’t have any.

− David Green

Interpretation

If the people who create, promote and manage deposits cannot accurately define this primary measure of value, why do you think that their actions will maximize it? Duration is not an intrinsic property; it is something that must be cultivated. If you are not careful, you can destroy it in an instant.

− David Green

Quote

Volume and value are not the same thing.

− David Green

Interpretation

If you plan to grow your loans and deposits faster than the market, how do you plan on acquiring the extra business? If you are going to lower your loan rates and increase your deposit rates relative to the competition, what do you think will happen to the profitability of your loan and deposit portfolios and therefore your bank as a whole?

− David Green

Quote

Asset-sensitivity is like a casino where you have to pay the doorman $100 to get in. Liability-sensitivity is like a casino where the doorman pays you $100 to go in.

Question 1: At which casino do you think most banks gamble?

Question 2: If they tell them at all, which casino do you think gamblers tell their spouses they frequent the most?

− David Green

Interpretation

In a banking context, asset-sensitivity comes with an upfront cost in the form of foregone earnings. This risk position is achieved by borrowing long and lending short (playing the opposite of the carry trade). When FTP is done correctly, the full and correct duration and liquidity value of deposits is paid out to the business units. If this value is not fully deployed on the other side of the balance sheet, the earnings drag should be captured in the mismatch center. More importantly, when the FTP math of duration and liquidity is done correctly, the earnings drag can be bifurcated into that associated with an interest rate mismatch and that associated with a liquidity mismatch. Of course, these are distinct risks and a bank can be long one while being short the other. If FTP is not done correctly (or is just a black box to people at the company), then it’s not clear what game is being played.

Caution: If you don’t know what game you are playing and what its risk-reward profile is, the casino can be a dangerous place.

− David Green