Archive for May 2019

ALM Conference – Toronto – May 2019

Seasoned Perspectives on the Past and Future of ALM I am honored to have participated in Risk’s ALM Conference in Toronto at the end of May. Along with several experienced…

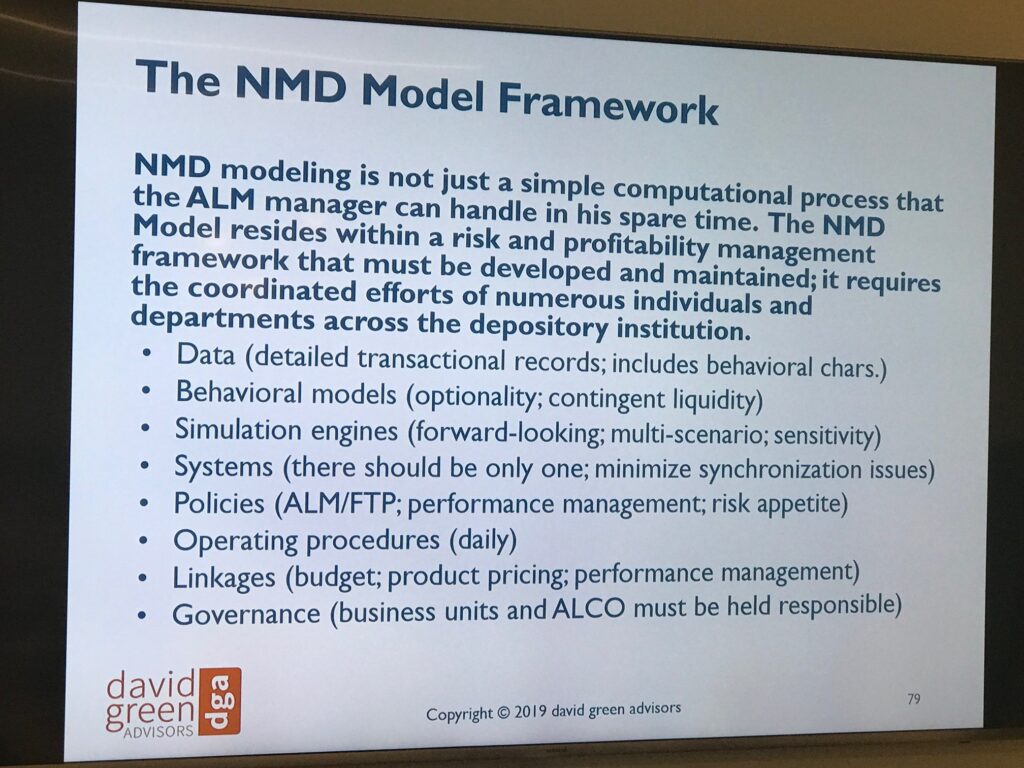

Read MoreNMD Workshop – Chicago – May 2019

A Methodical Approach to Developing and Managing a Model of Non-Maturity Deposits Thanks to everyone for attending my latest NMD Modeling workshop which was held in Chicago at the end…

Read More