Archive for October 2018

NMD Workshops, Q4, 2018: Bogota & New York – Update

Learn why rising interest rates are disrupting earnings expectations for so many depositories! Are your deposits misbehaving? Not as sticky and rate-insensitive as you thought they would be? This is…

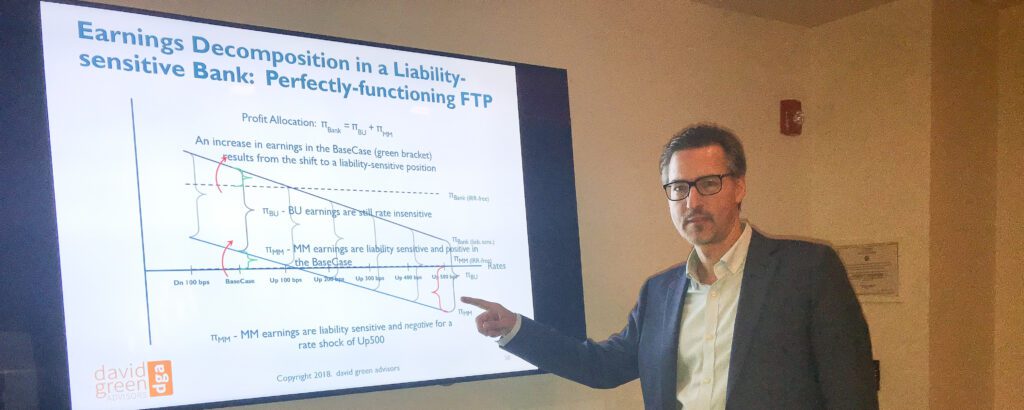

Read MoreFTP Workshop – Miami – October 2018

Are you confused about why your bank’s or credit union’s earnings are not materializing as expected? You don’t have to be! Perhaps the story of how your depository institution makes…

Read More