I am excited to announce our upcoming webinar on Non-Maturity Deposit (NMD) Modeling. Join me to discover the merits of my innovative approach to modeling NMDs in which the the treatment of behavioral cashflows is synchronized across risk and profitability…

Read MoreAfter two very long years of Covid-motivated webcasts, DGA is excited to announce the return of our live, in-person workshops. We have desperately missed these events and cannot wait to be back in front of a live audience. We are…

Read MoreI’d like to thank Omar Brown and the rest of the management team at Sagicor Bank in Kingston, Jamaica for inviting me to provide a 2-day ALM Workshop. Attendees included executive management, members of ALCO, the heads of major lending…

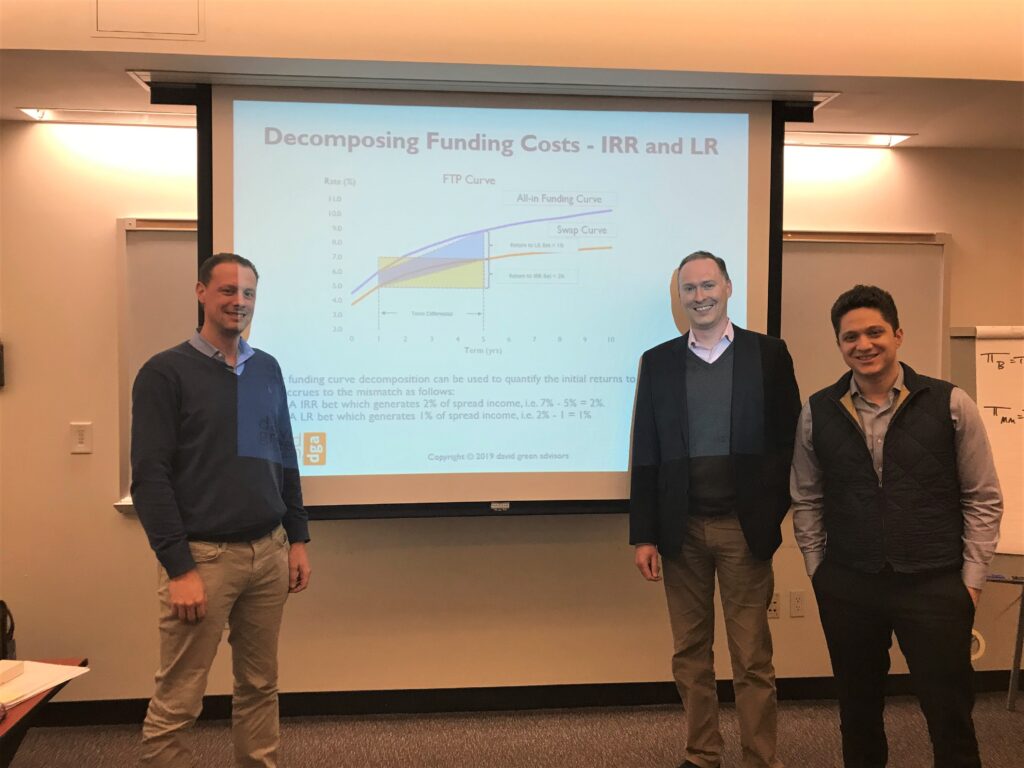

Read MoreAnnouncing The Following FTP Workshops For Q4 2018: San Francisco, 18-19 July 2019 Mexico City, 10-11 September 2019 Atlanta, 18-19 November 2019 With interest rates quickly changing direction, many banks are finding that their processes for computing and forecasting product-…

Read MorePreparing for a Change in the Direction of Interest Rate Movements I want to thank the delegates from banks in India, Puerto Rico and the US who attended my workshop in Miami this week. (As promised, mojitos were served and…

Read MoreI am excited to announce the publication of A Guide to Behavioral Modelling for ALM by Matteo Formenti and Umberto Crespi in which I contributed a chapter entitled Acknowledging the Elephant in the Room: The Mismatch Centre. My Chapter Summary:…

Read MoreSeasoned Perspectives on the Past and Future of ALM I am honored to have participated in Risk’s ALM Conference in Toronto at the end of May. Along with several experienced ALM managers, FTP managers and consultants (June Wang, Karl Rubach,…

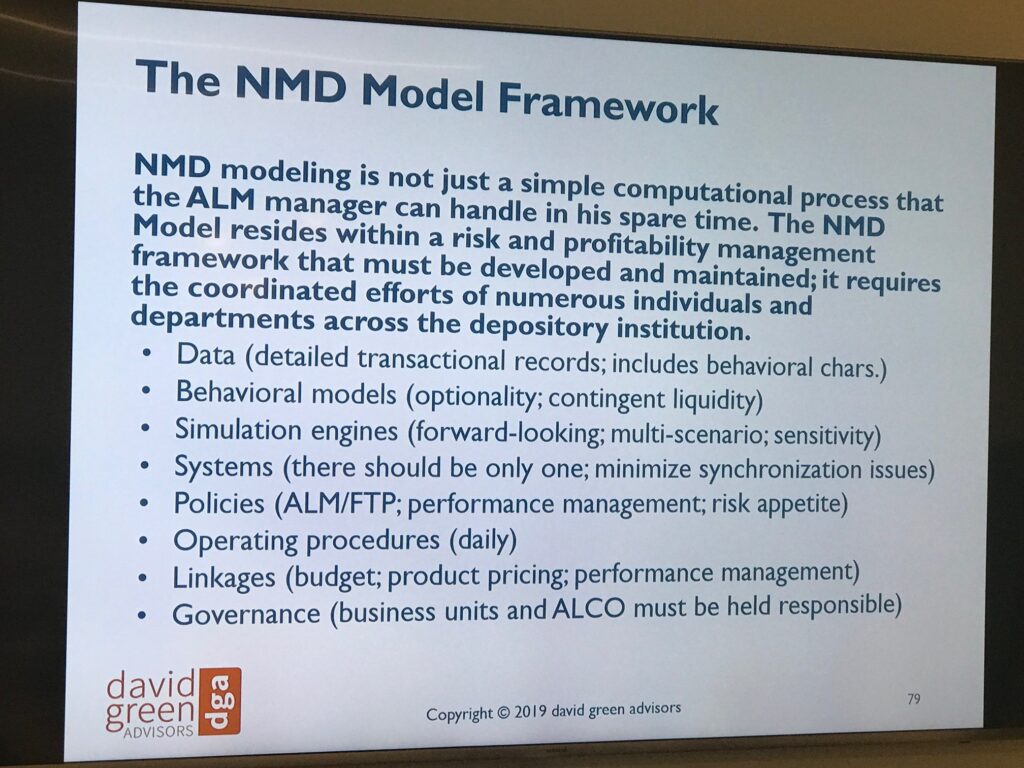

Read MoreA Methodical Approach to Developing and Managing a Model of Non-Maturity Deposits Thanks to everyone for attending my latest NMD Modeling workshop which was held in Chicago at the end of May. Several banks from across the US and South/Central…

Read MoreAre you ready for the next move in rates and liquidity spreads? Thanks to Marcus Evans and the delegates to my recent ALM Workshop in New York for another exciting discussion about the role of FTP in quantifying and managing…

Read MoreWow, I had an amazing time at my ALM workshop in Santo Domingo (and in Punta Cana afterward!). I want to thank all the delegates (representing all the major banks from the DR) who participated. It was an honor to…

Read More