Archive for August 2018

FTP Workshops, Q4 2018: Miami & Santiago

Announcing the following FTP Workshops for Q4 2018: Miami, October 18-19 Santiago, November 12-13 Now that interest are finally moving up, many banks are finding that their processes for computing…

Read MoreALM Workshops, Q4 2018: San Francisco & London

Announcing the following ALM Workshops for Q4 2018: San Francisco, September 6-7 London, October 3-4 With interest rates moving higher in many countries for the first time in a decade,…

Read MoreNMD Workshops, Q4, 2018: Bogota & New York

Announcing the following NMD Workshops for Q4 2018: Bogota, November 8-9 New York, November 28-29 As we move from a period of excess liquidity to an environment where depository institutions…

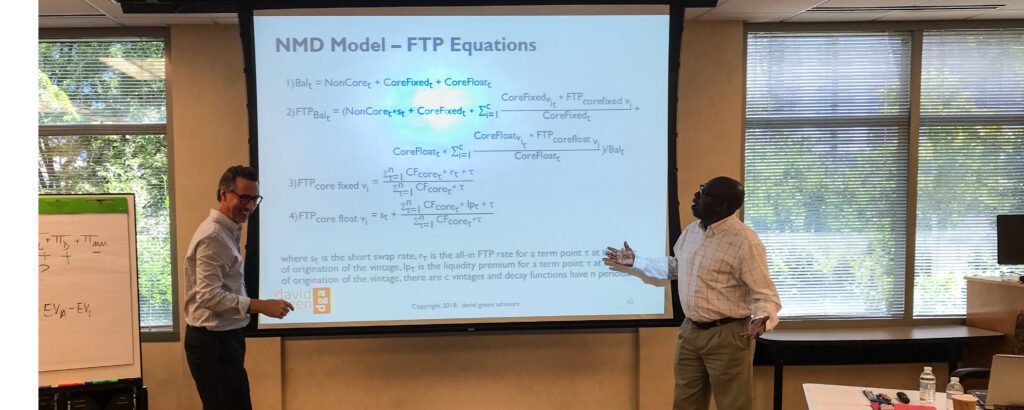

Read MoreNMD Workshop – Atlanta – July 2018

I want to thank everyone who attended my NMD workshop in Atlanta which was organized by Marcus Evans – I think it was the best session yet on the subject! …

Read More