Announcing ALM Workshops For Q1 & Q2 2019 Santo Domingo, Dominican Republic, February 21st-22nd, 2019 New York, New York, February 27th-28th, 2019 Miami, Florida, June 18th-19th, 2019 As interest rates moved higher last year, many depository institutions found that they…

Read MoreThanks to the large group of delegates from Colombia and Chile who attended my FTP workshop in Santiago. Once more, I observed that bankers in Central and South America are much more aware of the necessity for FTP for effective…

Read MoreThanks to everyone from Colombia and Dominican Republic who attended my deposit modeling workshop in Bogota. In addition to experiencing higher and more volatile interest rates relative to banks in the US and Europe, the introduction of non-bank financial intermediaries…

Read MoreLearn why rising interest rates are disrupting earnings expectations for so many depositories! Are your deposits misbehaving? Not as sticky and rate-insensitive as you thought they would be? This is not unusual as banks, credit unions and their regulators are…

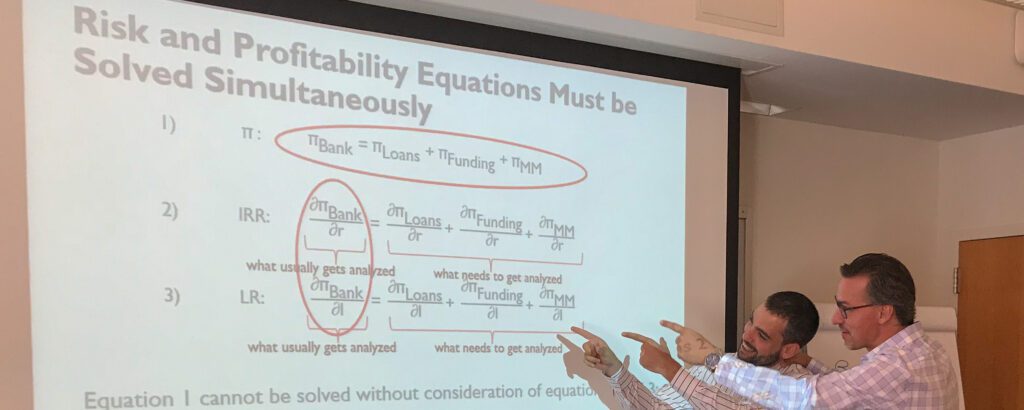

Read MoreAre you confused about why your bank’s or credit union’s earnings are not materializing as expected? You don’t have to be! Perhaps the story of how your depository institution makes money is not robust to rising interest rates. For most…

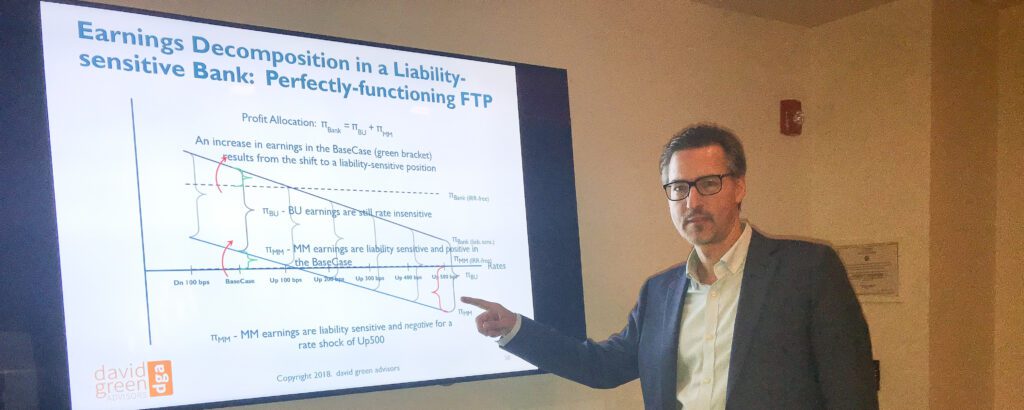

Read MoreAnnouncing the following FTP Workshops for Q4 2018: Miami, October 18-19 Santiago, November 12-13 Now that interest are finally moving up, many banks are finding that their processes for computing and forecasting product- and business segment-level profitability are producing more…

Read MoreAnnouncing the following ALM Workshops for Q4 2018: San Francisco, September 6-7 London, October 3-4 With interest rates moving higher in many countries for the first time in a decade, its been quite some time since banks have given much…

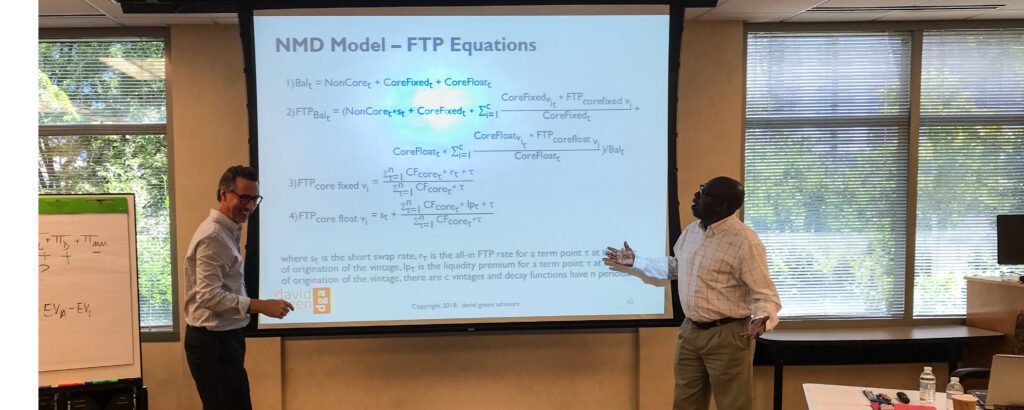

Read MoreAnnouncing the following NMD Workshops for Q4 2018: Bogota, November 8-9 New York, November 28-29 As we move from a period of excess liquidity to an environment where depository institutions are competing aggressively for funds, many firms are finding that…

Read MoreI want to thank everyone who attended my NMD workshop in Atlanta which was organized by Marcus Evans – I think it was the best session yet on the subject! (See the testimonial from Elliot Reis , ALM Manager at…

Read MoreI want to thank Marcus Evans and the delegates who came together for another exciting FTP workshop in New York. FTP managers, model validators and auditors representing banks from 3 different countries participated in the 2-day event. Everyone was thoroughly…

Read More- « Previous

- 1

- 2

- 3

- 4

- Next »