FTP Workshop – Miami – October 2018

Are you confused about why your bank’s or credit union’s earnings are not materializing as expected? You don’t have to be!

Perhaps the story of how your depository institution makes money is not robust to rising interest rates. For most firms, a well-functioning FTP framework is not the obvious answer, likely because no one there has ever seen FTP designed and operated correctly. FTP, as it as practiced at the majority of institutions large and small, is no better than no FTP at all!

One incorrect story is as useless as another incorrect story; neither prepare management for the challenges of navigating the firm through the business cycle.

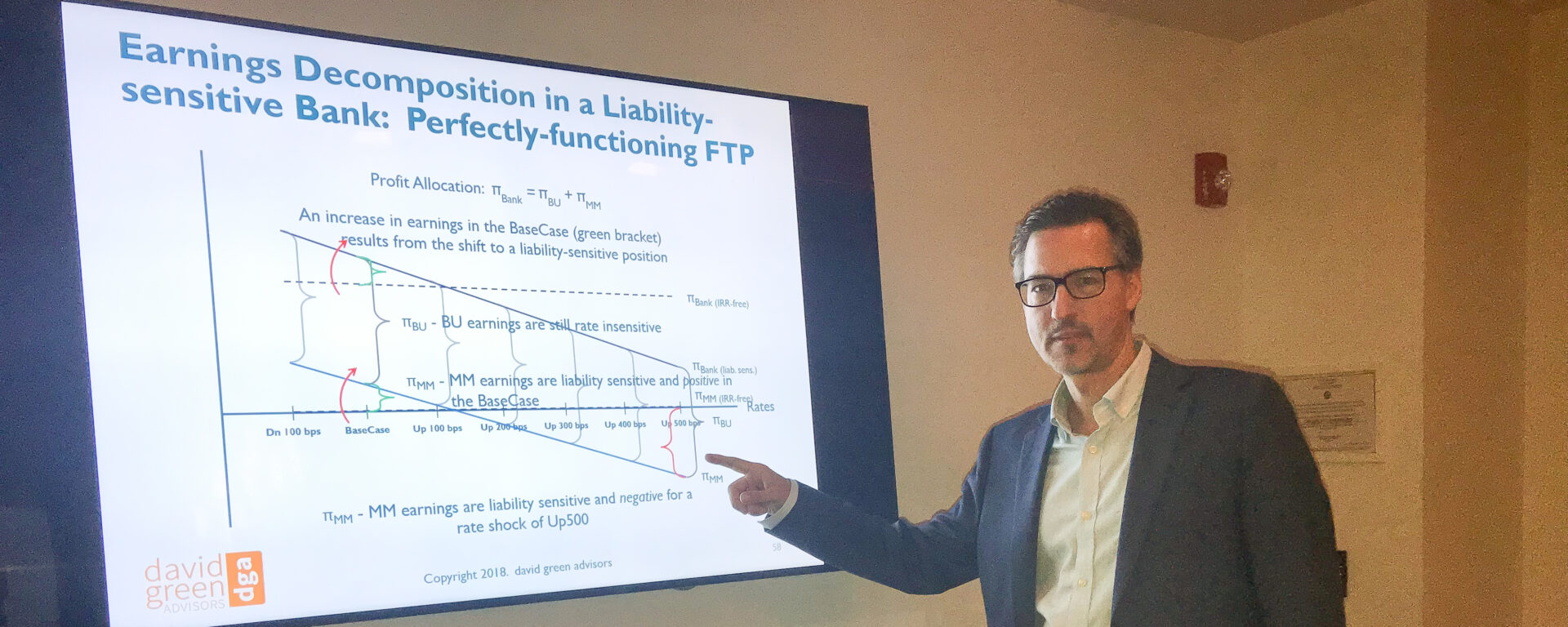

In my most recent FTP workshop, I explained why so many firms have set themselves and their shareholders up for disappointment. By ignoring the role of interest rate and liquidity risk in earnings dynamics, institutions are ill-prepared for the impact of rising rates.

Late on the first day, as we were discussing a couple of specific firms’ earnings challenges, their earnings reports hit the news wire. The timing could not have been more perfect. We pulled up managements’ discussions and found evidence of what we had just been discussing. Needless to say, the market’s dissatisfaction with managements’ ‘explanation’ was quickly felt.

If you are frustrated with your firm’s budgeting, forecasting and earnings management processes, I strongly urge you to attend my next workshop (CFOs and business segment managers are always welcome). For many, it will be the first time that they come to understand the essential role that FTP plays in risk AND profitability management. Still not sure this is the answer your are seeking? I’m happy to put you in touch with my clients who have developed comprehensive FTP frameworks which are highly-effective at identifying gaps and weaknesses in their business models that, once identified, can generally be rectified. It seems obvious, but if you don’t know where your weaknesses are, they have a way of sneaking up on you. Unfortunately, for many depositories, that time is now!

The benefits of FTP are available to every firm that chooses to tap into them. I can assure you that it doesn’t require a background in quantum math (as one CFO opined) or rocket science. It simply requires that you set aside pre-conceived notions about how your firm makes money. The process will reveal exactly the sources of income that can be exploited and those that, despite what you may want to believe, are not compelling.

I want to thank all of the delegates for their active participation in the discussion, honest expression of their doubts and fears and their open minds. In the end, the truth of FTP was writ large and clear for all to see, even the gentleman who was taking care of our class. I also want to thank the staff at the Betsy Hotel on South Beach; the wonderful food and well-lit space made for a relaxing, yet productive two days. I look forward to returning next year, but its time to prepare for my next FTP workshop which will be held in Santiago, Chile!