NMD Workshop – Chicago – May 2019

A Methodical Approach to Developing and Managing a Model of Non-Maturity Deposits

Thanks to everyone for attending my latest NMD Modeling workshop which was held in Chicago at the end of May. Several banks from across the US and South/Central America were represented.

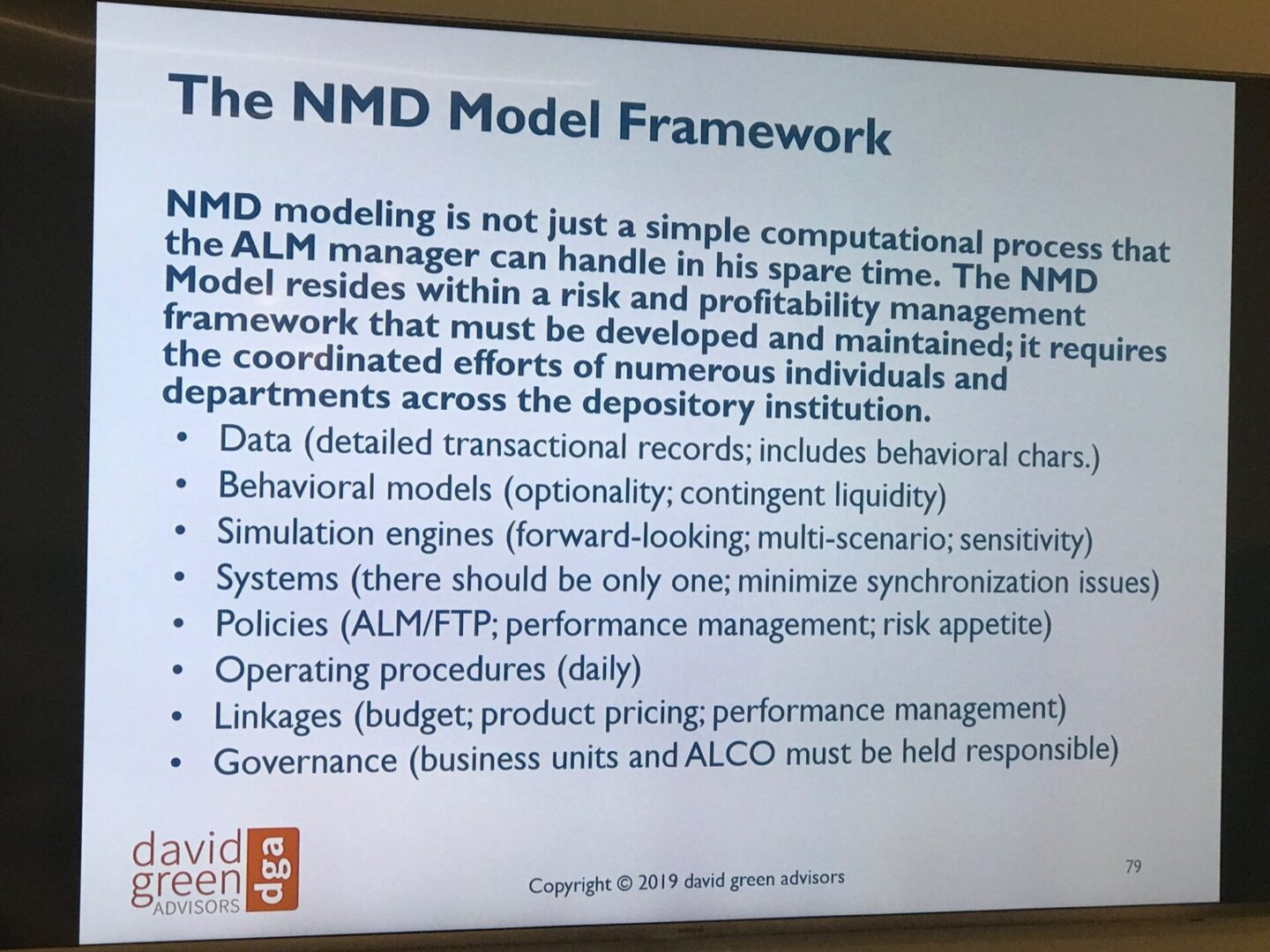

The workshop began with a discussion of the problems of interest rate risk, liquidity risk and profitability management, each of which requires that well-defined assumptions be established around the behavior of NMDs. In order that these problems be addressed consistently, I showed that any deposit modeling solution must speak simultaneously and consistently to their requirements. Model development and model maintenance will also only be effective if they exist within a comprehensive and well-defined NMD framework.

Delegates were provided with a demonstration of my NMD model. The model is used to produce re-pricing and liquidity cashflows for any ALM modeling exercise. In addition, the model contains its own FTP engine which is loaded with historical and forecasted basis-adjusted swap curves and liquidity premiums (consistent with a financial institution’s choice of funding curve components). With this information and the estimated cash flows, the model calculates FTP rates for each modeled product over the entire time series of historical data as well as a forecast horizon.

Delegates were able to see that when NMDs behave as anticipated, FTP spreads are stable; conversely, when behaviors deviate from expectations, FTP spreads widen or narrow accordingly. When FTP spreads from the model have been loaded into a budget or forecast, such deviations get the immediate attention of product management as well as the ALM manager; both are incented to determine why behaviors have deviated from expectations. To the extent that they cannot be brought back into alignment with expectations, model re-calibration is required.

Unique to the space, the NMD model is designed to be operated every month. The notion that a behavioral model for deposits need only be calibrated once a year or on some pre-determined schedule is ludicrous. With a financial institution’s equity levered to NMDs as much as 7-8 times, behavioral deviations must be identified immediately if an institution is said to be in control of its earnings and risk. The last couple of years have been testimony to this fact as we quickly transitioned from an environment characterized by excess liquidity to one where deposit demand suddenly pushed up rates on most products. Just as importantly, as we revert to a decreasing rate environment, we will see that many banks and credit unions will not realize how quickly they need to cut deposit rates in order to protect product and bank margins.

For information about upcoming workshops, see NMD Workshops.

For information about my NMD Model, see nmdmodel.com.