ALM Workshop – Santo Domingo – Feb 2019

Wow, I had an amazing time at my ALM workshop in Santo Domingo (and in Punta Cana afterward!). I want to thank all the delegates (representing all the major banks from the DR) who participated. It was an honor to share with them my vision for a comprehensive risk and profitability management framework.

Its interesting that in a country WITHOUT a functioning interest rate swap market and with a very illiquid and short term debt market that banks recognize the importance of FTP more than most do in the US. I believe this is the case because interest rates and the cost of liquidity are highly volatile which severely challenges the computation and analysis of business segment and product-level earnings. In contrast, in the US, the lack of rate and liquidity spread volatility has created a sense of complacency at most FIs; low volatility makes it relatively easy to forecast earnings no matter how simplistic or illogical the margin attribution process. When volatility returns to rate and liquidity markets, there will be many FIs that will be surprised by the impact this has on earnings.

The Fed (the regulatory side) should be careful of the unintended consequences of what the Fed (the monetary policy side) has done. They and the OCC published their first and only guidance on FTP in 2016 (OCC 2016-7a). It is technically only applicable to banks with total assets in excess of $250 bln (about a dozen firms); I suppose it doesn’t matter that smaller banks should not be able to quantify how much money they make from IRR and LR. Regulators mistakenly believe that FTP is only about dividing up the earnings pie and has nothing to do with risk recognition. Once you realize that FTP quantifies how much an FI makes by taking IRR and LR, its not a stretch to see that if IRR- and LR-related earnings are understated (at most banks the overwhelming tendency is to overstate lending and deposit gathering margins), management can be easily deluded into thinking that it has little exposure to IRR and LR.

In the workshop, we also discussed methods of imputing a base funding curve and a liquidity spread curve. While this remains a material challenge for all the banks in the DR (and many other LatAm countries as well), I believe that these rates can be reasonably estimated. Perhaps the systemic benefits of having a clearly-defined interest rate swap curve and a senior, unsecured term funding curve will compel the central bank and treasury department to instigate development of deep and efficient markets for risk transfer.

I am looking forward to working with the banks there to design, develop and implement robust analytical frameworks for risk and profitability. No doubt, it will be much fun.

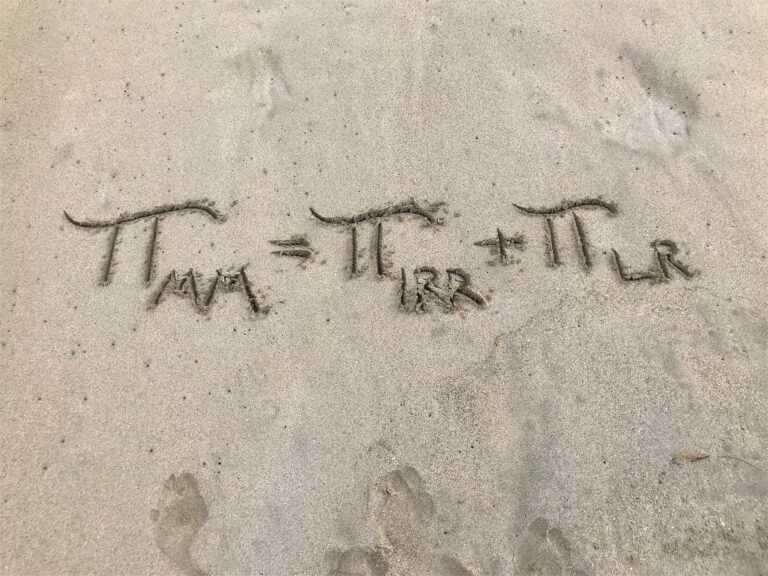

Of course, I am also looking forward to returning to Punta Cana where I can doodle in the sand.