Posts Tagged ‘ftp’

Non-Maturity Deposit Modeling Webinar

Join us for a 4-part webinar on Non-Maturity Deposit Modeling, where I discuss the development and management of NMD models for the use in asset liability management (ALM) and funds…

Read MoreNon-Maturity Deposit Modeling Webinar December 2023

I am excited to announce our upcoming webinar on Non-Maturity Deposit (NMD) Modeling. Join me to discover the merits of my innovative approach to modeling NMDs in which the the…

Read MoreFTP Webinar: Apr 2021

Funds Transfer Pricing: The Key to Effective Risk and Profitability Management Overview In this 4-part webinar (3 hours each Tuesday), we review lessons learned from the last several business cycles,…

Read MoreFTP ALM Webinar: Nashville, TN May 2022

Integrating Funds Transfer Pricing with Asset Liability Management: Ensuring the Alignment Between Risk and Profitability Management Overview In this 2-day workshop (live and webcast), we review lessons learned from the…

Read MoreFTP ALM Workshop May 2022: Live in Nashville and Webcast

After two very long years of Covid-motivated webcasts, DGA is excited to announce the return of our live, in-person workshops. We have desperately missed these events and cannot wait to…

Read MoreFTP Workshops Q3 & Q4 2019: San Francisco, Mexico City & Atlanta

Announcing The Following FTP Workshops For Q4 2018: San Francisco, 18-19 July 2019 Mexico City, 10-11 September 2019 Atlanta, 18-19 November 2019 With interest rates quickly changing direction, many banks…

Read MoreALM Workshop – Miami – Jun 2019

Preparing for a Change in the Direction of Interest Rate Movements I want to thank the delegates from banks in India, Puerto Rico and the US who attended my workshop…

Read MoreA Guide to Behavioural Modelling for ALM

I am excited to announce the publication of A Guide to Behavioral Modelling for ALM by Matteo Formenti and Umberto Crespi in which I contributed a chapter entitled Acknowledging the…

Read MoreALM Conference – Toronto – May 2019

Seasoned Perspectives on the Past and Future of ALM I am honored to have participated in Risk’s ALM Conference in Toronto at the end of May. Along with several experienced…

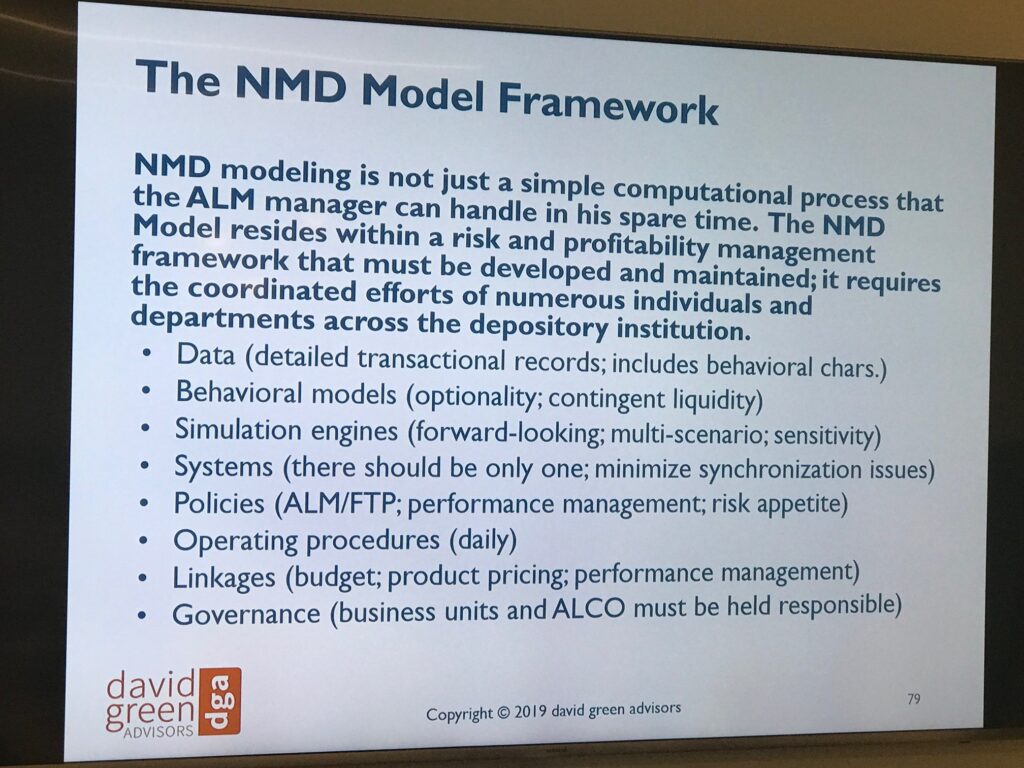

Read MoreNMD Workshop – Chicago – May 2019

A Methodical Approach to Developing and Managing a Model of Non-Maturity Deposits Thanks to everyone for attending my latest NMD Modeling workshop which was held in Chicago at the end…

Read More